From New Dawn 145 (Jul-Aug 2014)

Modern technology has created a brave new electronic and borderless world. Surveillance and biometric capturing technologies have advanced significantly in recent years. ID programs have modernised with the likes of ID smartcards linked to huge databases enabling fast and secure electronic authentication among other surveillance functions.

Advances in digital technologies have made it possible now to construct an identification system capable of monitoring just about every human transaction. The surveillance society is no longer a future probability but a very present reality.

As Martin Hirst, Associate Professor at Deakin University observes: “…we are clearly living in a well-established surveillance society.”1 This surveillance society has at least several disturbing implications as Hirst proceeds to explain:

Everything you do is subject to surveillance… We are under constant watch, both physically and electronically. Surveillance is the new normal. It’s everywhere and this ubiquity makes us take it for granted.2

That ubiquitous surveillance has achieved an almost imperceptible presence in our lives is captured in remarks by Julian Assange in an interview with Global:

The web accelerated the network’s proliferation into every aspect of modern daily life in advanced societies. The speed of that transformation has left global society unaware of the political and societal implications of using a one-world network as the central nervous system of humanity. Foremost among those implications was the globalisation and totalisation of surveillance.3

Indeed it’s a profound transformation unfolding as advanced surveillance technologies become smaller, faster and far more powerful and effective. But more, it reveals an eerie dimension to modern surveillance in that while it has become pervasive, it is also now largely invisible. Accordingly, the erosion of freedoms and privacy, and the impacts on social inclusion and exclusion go almost unquestioned. We’ve become preoccupied with the need for high-tech solutions to everything, whether it’s ensuring robust security and safety or prevention of identity fraud and crime.

Few surveillance instruments are as effective for monitoring the movements of individuals as smart ID cards, particularly when empowered by modern technology and infrastructure. The Secretary General of Interpol and the EDAPS Consortium clearly know this when in an intriguing announcement in 2011, called for development of an electronic “Globally Verifiable Identity Card.” The card was envisaged to be embedded with a contactless microchip and integrated biometric technologies providing “automation of border and migration control at all levels” and verifiable “through national and international databases.”4

Taking the globally verifiable identification card to a new level is this curious proposal by science fiction writer Elizabeth Moon, who told BBC in 2012 that to change the world everyone should be issued a unique ID barcode or implantable chip:

… I would insist on every individual having a unique ID permanently attached – a barcode if you will; an implanted chip to provide an easy, fast inexpensive way to identify individuals…5

Moving forward to 2014, is this chorus of calls for ubiquitous surveillance, global ID systems and universal human chip implants merely the paranoid fantasies of spirited imaginations?

Renewed calls for the beefing up of the world’s surveillance systems appear to come on the heels of nearly every major breach of security. Malaysia’s missing airliner MH370 on 8 March 2014 is a good case in point. Given the frustration with the search for the missing aircraft, China announced at the end of March a curious plan involving “massively increasing its network of surveillance and observation satellites so it can monitor the entire planet.”6

Audacious proposals for high-tech surveillance should give anyone pause for concern. However, it seldom does. As a UK public discussion report notes, the surveillance society is widely “seen as the stuff of science fiction, not everyday life.”7

‘Receive a Mark in Their Right Hand or in Their Foreheads…’

It may seem like the stuff of science fiction but a world in transformation driven by the technology of the age also signals a biblical prediction coming into view. Referring to a mark embedded at the right hand or forehead of every individual, we turn to consider a fascinating verse from the New Testament that describes a centralised world financial order.

Revelation 13:16-17 reads:

He causes all, both small and great, rich and poor, free and slave, to receive a mark in their right hand or in their foreheads, and that no one may buy or sell except one who has the mark or the name of the beast, or the number of his name. (King James Version)

These verses come from the book of Revelation written in the latter part of the first century CE. The author is traditionally known as John, the book’s original Greek title is ‘Apocalypse’ which means a prophetic disclosure or ‘Revelation’ from where the latter title of the book originated.

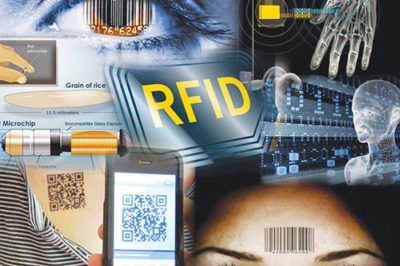

While the ‘mark’ has been a topic of debate for many years, its concept remains to be seen. Will the mark be a symbolic representation or a functioning hardware device? Will it be a visible inscription or concealed subcutaneous implant? Could it be a hybrid of any of these? Current technologies and techniques already have potential to meet any one or more of these adaptations with variations of scannable tattoos, implantable chips and a growing range of innovative wearable devices.

Looking at the passage more broadly, scholars of eschatology generally interpret the verses with view of a world dictator (“He”) who exercises global authority and control (“causes all to receive”) using a specialised instrument (“a mark”) to enforce a draconian compliance policy (“that no one may buy or sell except one who has the mark”).

A crucially important detail in this passage is the mark embedded at the right hand or forehead, suggesting an indispensable device in a newly established opt-in economy in order to buy and sell, with profound implications for surveillance and control. Surveillance of one’s consumer activities was until recent times a cumbersome process, but with the explosion of a new generation of cashless payment technologies, that has all radically changed.

Indeed, the shopper of today who prefers cashless methods of payment already leaves a trail of digital records that can be tracked and monitored with ease through their daily online and offline shopping activities. The reason for raising an alarm here is that we can already demonstrate the technical capacity to engineer a completely cashless and paperless economy, outfitted with a centralised global digital currency and embeddable device to replace all existing methods of payment. There would be no means or avenue of escape from this horrendous tightly controlled surveillance complex.

This seems to be the economic model that the passage is describing, and the narrative this analysis will explore, as we look at a few samples among many emerging innovations and developments to affirm that this is the direction the world is heading. It is also important to consider what these technologies and innovations portend with regard to their possible precursor to the mark, and how they may be familiarising users to be more receptive of an embedded bodily device through exposure and usage.

RFID Technology & Chip Implants

Radio Frequency Identification (RFID) chips have been the object of a great deal of sensationalist commentary over the years.

So what are RFID chips? RFID chips are basically an automatic data capture technology that contains unique identification codes that are readable at varying distances with special reader devices. The tiny size of the chips, about that of a small grain of rice, and their widening deployment over the years, has generated broad publicised concerns about potential privacy invasion.

These fears are not unfounded. It’s already a mandatory requirement in six states of Australia8 and other parts of the world that domestic animals be implanted with a microchip containing identity data linked to a microchip registry. What starts out voluntary often becomes mandatory.

While deployment of human chip implants in the mainstream has not materialised, it has in no way dampened the spectre of what could be.

As Time magazine opined back in 1998:

Your daughter can store the money any way she wants – on her laptop, on a debit card, even (in the not too distant future) on a chip implanted under her skin.9

Similarly, CNET News 2003, where we read about MasterCard testing RFID technology for the PayPass credit card to be fitted with a chip, states:

It could be in a pen or a pair of earrings. Ultimately, it could be embedded in anything – someday, maybe even under the skin.10

A more recent article on BBC sought to inform readers that “it’s the same exact technology as the card in your wallet” to allay fears of “surveillance and totalitarian control” toward microchip implants. Unlike cards that can be lost or stolen, “you’ll never lose the chip,” assured the advocate of the technology. In remarks that read like a glowing endorsement of microchip implant techniques:

An implanted chip, by contrast, could act as our universal identity token for navigating the machine-regulated world. Yet to work, such a chip would need to be truly universal and account for potential obsolescence…. It marks the beginnings of a slow move toward a world where everything will be accessed from a single RFID microchip. If that day comes, I can’t think of a safer place to keep it than inside my own body.11

Promoting mainstream use of human chip implants through the health care industry was a curious television commercial for VeriChip Corp in 2008. Featuring a sequence of patients holding forth a tiny microchip, the ad wastes no time enticing audiences with these apparent assurances:

To think something so small can connect you to everything that matters. When your life and all you love are on the line, Health Link is always with you. When every second counts in the emergency room, providing immediate access to your medical records….12

Cybernetics scientist Dr. Mark Gasson of the University of Reading in Britain foresees human chip implants becoming one of life’s necessities in the near future, according to citations in the Sydney Morning Herald in April 2014:

It’s not possible to interact in society today in any meaningful way, without having a mobile phone. I think human implants will go along a similar route. It will be such a disadvantage not to have the implant that it will essentially not be optional.13

Are these remarks the creative plot for a sci-fi thriller or do they foreshadow biblical mark realities?

By contrast, it was fears of RFID chip implants “becoming widespread in humans” that prompt this warning in the same Sydney Morning Herald article, citing Dr. Katina Michael, an associate professor at the University of Wollongong:

They point to an uber-surveillance society that is big brother on the inside looking out. Governments or large corporations would have the ability to track people’s actions and movements, categorise them into different socio-economic, political, racial, religious or consumer groups and ultimately even control them.14

The spectre of human microchip implants looms.

Smart Chips & Contactless Payments

Contactless payment processes have opened a new chapter in fast, convenient and cost effective methods of payment. Many readers of New Dawn would be familiar with the contactless payment services available in many retail stores.

MasterCard® PayPass™ and Visa payWave are two established contactless payment services on offer throughout Australia. These services provide contactless payment point-of-sale readers that utilise sophisticated smart chip technology to enable users to make payments with little more than a simple wave of a card. No swiping or inserting the card at the terminal, nor a PIN or signature required for purchases under $100.00.

Unlike the standard RFID chip, the smart chips in cards contain an antenna loop embedded in the plastic. The far more sophisticated modern chip and their variations still use radio frequency technologies but incorporate a microprocessor and internal memory for read/write and secure data storage and management. Contactless smartcards exchange information with payment terminals using short-range wireless communications and conform to the international standard ISO/IEC 14443 that limits the ability to read and write to the contactless device at a distance less than 10 centimetres.

The significance of these developments cannot be overstated considering the rapid deployment of converging contactless payments and chip card enabled payment innovations in recent years. It could be said that there’s little experiential difference between making a contactless payment with a wave of a card and a contactless payment with a wave of the right hand. If exposure and repetitive use breeds familiarity, then user sensitivities toward an embedded device-enabled payment paradigm are certainly being numbed.

Quick Response (QR) Codes

Could scannable tattoos become what is the mark that enables those who receive it to buy and sell?

QR codes are two-dimensional machine-readable graphics which consist of a matrix of black modules arranged in a square on a white background. QR Codes are similar to standard barcodes except QR Codes can contain much more information than traditional barcodes.

QR Codes link the physical with the digital world. They are often displayed on brochures, business cards, posters, clothing and other print advertising. When scanned by a smartphone or device, the QR Code directs the user to a website, phone number or other information.

Incidentally, QR codes also enable payments by linking the user’s bank account or credit card information to their unique QR Code. Depending on the app, users can either pay by scanning a QR code, displayed on a bill for example, with their smartphone or merchants can accept a mobile payment by scanning a customer’s unique QR Code on their smartphone.15

While QR codes have been around since the 1990s, it’s only with recent technology we see their extraordinary versatility with enabling a variety of mobile payment methods.16 There’s also been a strange twist to this technology with claims of scannable QR Code tattoos.17 It may be a futuristic and bizarre claim to make that one day such tattoos could enable payments much like the passage describes the mark, but it just goes to show the technology and technical capability is here.

Wearables, Smartphones & Mobile Devices

Software applications and near field communications (NFC) among other innovations are rapidly transforming payment processing ecosystems, creating a new era of convenient and fast payment services, with converting phones and other mobile devices into full digital wallets.

It’s claimed the new digital wallet will soon eliminate any need to carry cash and cards, allowing users to link their debit and credit cards to conduct financial transactions all at the press of a few buttons on a device.18 Once the user has established an account, users can ‘tap’ their phone to pay for shopping at the checkout or pay a friend by transferring money from mobile to mobile.

Enterprising Australian banks and financial service organisations are pressing onward with trials and roll outs of their infrastructure across the country.19 Trials are even being conducted on a payment microchip embedded in the sleeve of suits at the cuff for easy and convenient payments.20 There’s also digital payment bracelets, wristwatches and other wearable payment devices now commercially available.21

It seems the acceleration toward a cashless society is becoming like one of an amusement arcade amid the range of novel payment devices coming onto the market. These innovative payment devices are yet another novelty enticing customers toward fully traceable and trackable digital transactions, indeed cultivating user familiarity with a variety of cashless and contactless methods of payment.

Biometric Enabled Payment Devices

Biometric payment innovations add yet another range of options for the customer to pay, with biometric scanning devices enabling methods of payment typically with finger, hand or face. A familiar range of benefits are advanced including simplicity, speed, convenience and security of payment.

PayTouch22 and MyTouch23 are two services that allow users to link their payment cards to their fingerprint for method of payment.

PayPal, a global payment company, has partnered with Samsung to launch a biometric fingerprint authentication payment option enabled by the Fast Identity Online (FIDO) Alliance ready software. The collaboration allows Samsung Galaxy S5 users to be able to login and shop at any merchant that accepts PayPal on mobile with their fingerprint.24

If there exist any payment technique that could be said to simulate conducting payments with an embedded mark at the right hand or forehead, that would surely belong to emerging hand and face biometric methods of payment.

Biyo is touted as a revolutionary biometric digital wallet that allows users to pay with their hand by scanning the unique vein patterns in the palm to create a secure password. The point-of-sale system requires users to register their palm and link it to a credit card of choice. Once registered, the user can make payments simply with their hand at any store where the Biyo terminal is available.25

It’s trumpeted as the world’s first face recognition payment system and comes from a Finnish start-up company called Uniqul. Uniqul are developing real-time facial recognition payment technology to replace cash, cards and phones and aspire to “revolutionise the world of payments with new paradigms to create amazing payment experiences for users.”26

There is little presence of biometric payments in Australia, however in a recent move toward this initiative, digital banking tech provider The Systems Work Group have taken on eye-print recognition technology for authenticating mobile banking app users.27

Accelerating Social & Economic Transformation

Africa and India offer compelling evidence of the radical transformative impacts of cashless technologies on societies and economies.

The African experience is an amazing transformation, a continent exhibiting by far the fastest growth in mobile money economics in the world amid deep and broad social disadvantage. Mobile money enables users through payment schemes such as SnapScan and M-Pesa to make a variety of financial transactions with just their phone, even where conventional payment infrastructure is unavailable.28

An extraordinary feature of Africa’s mobile money implementation is that they have leapfrogged over vital infrastructure otherwise necessary for consumers to engage a modern economy:

The lack of financial and technology infrastructure could have been perceived as a massive barrier, but instead Africa has managed to leapfrog over a world of credit cards, ATMs, bank managers and branches.29

Evidently the absence or lack of infrastructure is accelerating the transition to a viable cashless society in this instance.

A similar technological marvel is unfolding in India with the ambitious rollout of a 12-digit unique ID number known as an Aadhaar to all 1.2 billion residents across the country.30

The Aadhaar number is stored in a centralised database and links to the basic demographics and biometric information of each individual. It is the largest biometric database in the world. The mission is to empower all residents of the country with a unique identity and a digital platform to authenticate anytime and anywhere.

The program enables millions of rural and poor people through financial inclusion to participate in the modern cashless economy.31 Of important note here is the aim of the ID, as with all sophisticated ID schemes around the world: To create a detailed digital record of everywhere the ID holder goes.

It’s a fascinating spectacle of technological revolution and accelerating social and economic transformation on a scale seldom if ever seen. Interestingly, when we compare the systems of the mark and Aadhaar, we note a similar layout where both models utilise a unique ID mechanism to enable access to the financial system of the day. To restate in part:

He causes all, both small and great, rich and poor, free and slave, to receive a mark…. and that no one may buy or sell except one who has the mark.

En Route to the Global System of the Mark

Global citizenship and mobility, international trade, global financial markets and high speed technologies have connected individuals and communities beyond our national borders. Increasingly we’re all part of a connected globalised economy in an era of normalising the digital way of life.

It would have taken some penetrating foresight in decades past to have envisioned the role technology would play today with enabling almost the entire world’s population access to an advancing modern economy, including the world’s poor: “He causes all… rich and poor… to receive a mark…” Yet, here we witness today this incredible transformation unfolding in places such as Africa and India and elsewhere.

In an interesting note, the Center for Financial Inclusion, citing a convergence of financial inclusion elements including convenient payment systems and the mobile money revolution, envisions global financial inclusion now within reach.32 Cashless technologies are seen contributing to this “profound demographic shift.”33

Indeed, it’s these cashless technologies that signal an approaching mark-based enabled buy and sell system with each passing day. It wasn’t many years ago that a global cashless society was even technologically feasible, but we now have the computing capacity and power to make it all happen, and very quickly if need be.

When we look carefully at what the passage is saying, we can actually see described in this ancient text today’s landscape of cashless and embeddable technologies, which is the system of the mark in its embryonic stage development. As such, the pace at which the world is approaching this prophecy may well be synced to the quickening technological progress taking place around us.

Engineering the Global Surveillance Society

The cashless society adds a vast new dimension to the surveillance society. Further to being tracked using conventional surveillance techniques, any user of the Internet, credit card or mobile device can now be monitored by their computer and consumer activities.

As was earlier outlined, the surveillance society had already arrived with little public awareness of, and appreciation for, its pervasive presence in our lives. A similar phenomenon is confronting us today with the cashless society and fewer still are alert to its encroaching consequence.

We now embrace surveillance like a dangerous liaison with our preoccupation for everything digital and mobile. As journalist and author Pratap Chatterjee observes:

Today, the surveillance state is so deeply enmeshed in our data devices that we don’t even scream back because technology companies have convinced us that we need to be connected to them to be happy.34

Exclusive use of cash in the new surveillance economy provides some level of anonymity but even these efforts will be futile when the day arrives that cash is made obsolete.

What could it take to galvanise governments into establishing a purely closed digital economy incorporating a device embedded in every individual to buy and sell?

ID cards, payment cards and mobile devices can be lost, stolen and broken. Accordingly, precursor technologies would converge to create the mark, reconstructed as a hybrid of a unique ID and digital wallet device, embedded in the right hand or forehead for a fully integrated security solution.

How about a crisis of such consequence that threatens world security and social order? With looming global threats and ongoing instabilities, countries teetering on catastrophic financial collapse amid increasing terrorist activity and conflicts abroad, the shifting sands of the current fragile world order would seem to be signalling its systemic breakdown.

Perhaps in the midst of such turmoil or following a worldwide economic meltdown, comes a momentous shift to a cashless society with an embedded device compulsory for every individual to participate in the new global financial order. However, the newly hatched revolutionary system will be one that ensnares humanity in a totalitarian global surveillance society unlike the modern world has ever seen given such advanced technology in place. We have already crossed the Rubicon.

Footnotes

Note: All links and web pages accessible at time of publication

- M. Hirst, ‘Someone’s looking at you: welcome to the surveillance economy’, 26 July 2013, at theconversation.com/someones-looking-at-you-welcome-to-the-surveillance-economy-16357

- Ibid

- ‘Global mass surveillance should be discontinued immediately’, Global: the international briefing, 2014, at www.global-briefing.org/current-issue/

- Y. Shostak, ‘Global Identity Verification and Migration Mobility Control’, MRTDs, Biometrics and Security Standards (2011) Montreal ICAO, 12 September 2011 at www.icao.int/Security/mrtd/7th/Documents/12_am_edaps.pdf and ‘Interpol chief calls for global electronic identity card system’, 6 April 2011 at www.net-security.org/secworld.php?id=10860

- ‘Barcode everyone at birth’, BBC Future, 22 May 2012 at www.bbc.com/future/story/20120522-barcode-everyone-at-birth

- See S. Chen, ‘China mulls global satellite surveillance after flight 370 riddle’, 30 March 2014 at www.scmp.com/news/china/article/1460652/china-mulls-global-satellite-surveillance-after-flight-370-riddle

- D. Murakami & K. Ball, et al (Eds) ‘A Report on the Surveillance Society’, September 2006 at www.dataprotection.ie/docs/A-Report-on-the-Surveillance-Society-For-the-Information-Commissioner/386.htm

- ‘Is microchipping mandatory for cats and dogs?’ at kb.rspca.org.au/Is-microchipping-mandatory-for-cats-and-dogs_287.html

- J.C. Ramo, ‘The Big Bank Theory’, TIME, 27 April 1998 at content.time.com/time/magazine/article/0,9171,988228,00.html and for full published version see content.time.com/time/magazine/article/0,9171,139035,00.html

- D. McCullagh, ‘Chip implant gets cash under your skin’, CNET news, 25 November 2003 at news.cnet.com/2100-1041-5111637.html

- F. Swain, ‘Why I want a microchip implant’, BBC Future, 10 February 2014 at www.bbc.com/future/story/20140209-why-i-want-a-microchip-implant

- See www.youtube.com/watch?v=wW_eAQN7oks

- I. Gillespie, ‘Human microchipping: I’ve got you under my skin’, Sydney Morning Herald, 16 April 2014 at www.smh.com.au/digital-life/digital-life-news/human-microchipping-ive-got-you-under-my-skin-20140416-zqvho.html

- Ibid

- ‘Hot issues in payment: QR code and NFC payment’, Payworks, 30 September 2013 at payworksmobile.com/blog/2013/09/30/hot-issues-in-payment-qr-code-nfc-payment/ and ‘QR Codes for Marketing: A Unique Way to Bridge Offline and Online Media’, Human Service Solutions, at www.hswsolutions.com/services/mobile-web-development/qr-code-marketing/ and ‘QR Code’ at en.wikipedia.org/wiki/QR_code#cite_note-26

- See www.youtube.com/watch?v=dAywQ6spop4

- ‘Brave hipster gets animated tattoo using a QR code’, Relaxnews, 11 August 2011 at www.news.com.au/technology/brave-hipster-gets-animated-tattoo-using-a-qr-code/story-e6frfro0-1226113101876

- B. Voo, ‘Digital Wallets – 10 Mobile Payment Systems To Take You There’, Hongkiat at www.hongkiat.com/blog/digital-wallets/

- A. Bender, ‘Mobile payments in Australia: state of the banks’, Computerworld, 29 January 2014 at www.computerworld.com.au/article/536949/mobile_payments_australia_state_banks/

- S. Colqhoun, ‘The world’s first payWave suit’, The Age, 23 April 2014 at www.theage.com.au/executive-style/style/the-worlds-first-paywave-suit-20140422-371xp.html

- L. McQuarrie, ‘From Digital Payment Jewelry to Credit Card Timepieces’, 14 August 2013 at www.trendhunter.com/slideshow/payment-devices

- See www.pay-touch.com/en/home

- See www.mytouchpayments.com/default.aspx

- A. Vrankli, ‘PayPal and Samsung launch FIDO authentication and fingerprint payments for Samsung Galaxy S5’, Biometric Update, 25 February 2014 at www.biometricupdate.com/201402/paypal-and-samsung-launch-fido-authentication-and-fingerprint-payments-for-samsung-galaxy-s5

- See biyowallet.com/

- See uniqul.com/

- ‘Eyeprints To Protect Mobile Banking Transactions’, Find Biometrics, 28 April 2014 at findbiometrics.com/eyeprints-to-protect-mobile-banking-transactions/

- L. Erasmus, T. Kermeliotis, ‘No cash, no cards: Mobile app lets you pay with just your smartphone’, CNN Marketplace Africa, 20 February 2014 at edition.cnn.com/2014/02/20/business/no-cash-no-cards-just-smartphone/index.html?hpt=hp_bn1

- R. Botsman, ‘Mobile money: The African lesson we can learn’, Financial Review, 14 February 2014 at www.afr.com/p/boss/mobile_money_the_african_lesson_CwCeQ00CdCxlpFijNamvgM

- ‘AadHaar’ at en.wikipedia.org/wiki/Aadhaar

- Ibid and see ‘From Exclusion to Inclusion with Micropayments’, UIDAI Planning Commission, April 2010 at uidai.gov.in/UID_PDF/Front_Page_Articles/Strategy/Exclusion_to_Inclusion_with_Micropayments.pdf and ‘Aadhaar: Financial Inclusion through online authentication’, Aaadaarh UIDAI at www.youtube.com/watch?v=3aQJztNif94

- ‘Seizing the Moment: On the Road to Financial Inclusion’ by the Center for Financial Inclusion, October 2013 at centerforfinancialinclusionblog.files.wordpress.com/2013/11/seizing-the-moment-fi2020-synthesis-report.pdf

- E. Zuehlke, ‘Cashless Technology One Piece of the Financial Inclusion Puzzle’, MasterCard, 4 February 2013 at newsroom.mastercard.com/2013/02/04/cashless-technology-one-piece-of-the-financial-inclusion-puzzle/

- P. Chatterjee, ‘Mining your information for big brother’, Asia Times Online, 15 October 2013 at www.atimes.com/atimes/World/WOR-01-151013.html

© New Dawn Magazine and the respective author.

For our reproduction notice, click here.